An amount of content must have all high requirements at the start of 2021, which resulted in a series of optimistic predictions for the remainder of the year. For example, consider the following: By the summer of 2021, Citi experts estimate that the value of A bitcoin will have reached $300,000 per coin. Even though Citigroup does not provide specific figures, it indicates that Blockchain has the scope for growth. It interacts with diamonds to hold money as an alternative to the current financial assets. According to Stock-to-Flow (S2F), a Trading volume estimation algorithm, BTC/USD will hit $100,000 by December 2021. Mike Bloomberg, the operator of a digital hedge fund, cites $65,000 as a feasible goal. Xinhua writer Mike Big opportunity sets a target of $50K for one bitcoin in 2021. and $170K about one bitcoin in 2022. It is currently essential to examine this extremely dangerous business from two perspectives to create a prediction for bitcoin for at most a few months left.

The Emotions of Investors Are Being Studied

To date, the Overall statistic, which incorporates all bitcoins, has increased by almost 1000 percent from the beginning of the global anxiety in March of this year. It’s hard to adjust to the economies (5) related to the rising program’s arcs. From April to November, the index grew steadily, indicating that it is in the distribution center. However, after that, there was a “burst,” and the expansion increased. The index climbed towards the top zone and then fully “went off onto the meter” is above platforms, indicating that it had entered an extreme condition.

The Google Searches also means the business is now experiencing overheating. A similar surge in curiosity in Bitcoin’s development has been seen globally (6), with the most recent occurrence in January 2017 (7). Individuals have seen that Bitcoin (BTC) has twice exceeded the historic high of $20,000. They may have endured the typical FOMO (negative emotion out) impact that is fundamental.

Analysis of the Total Volume

Launched in December, the bilateral trade was 3.5 times greater than the national median of its time! It hasn’t altered in a significant way. Why? The most probable reason is that coins are being transferred on a broad scale from experts (who have not been scared to invest in bitcoin after March) to a significant number of novices who hurried to purchase bitcoins under the impact of hormones.

Bitcoin Predictions For 2021 By Financial Technology Industry Professionals

Acceptance across the Board

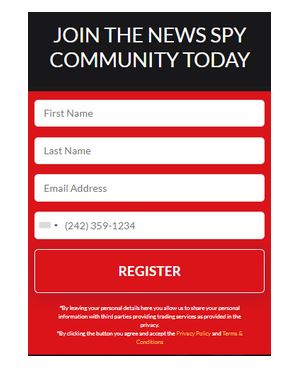

It has become a chicken-and-egg issue when it comes to Bitcoin’s usage in daily life. After one aspect, very few people use or recognize it since few people use or acknowledge it. However, the year 2020 has witnessed a remarkable rise in the popularity of bitcoin adaption. Popular fintech firms, ranging from Square’s $ 50 million commitment in bitcoin to the Payment gateway, which enables its customers to purchase and sell bitcoin, have stamped their approval on the cryptocurrency. Start your trading career effectively with thenewsspy.technology .

Competition in The Big Tech Industry

Even if it hasn’t been around for a month, everything else bitcoin-related has prompted many of the world’s biggest companies to explore providing worldwide digital money to their customers. Every business engaged in the payment sector recognizes that there is a business for financial inclusion that is intended to be kept and that expenditures incorporating a combination of functional areas have tremendous potential to grow in the future. This is since such activities may take many days to complete and can be very expensive. Bitcoin has already shown that modern communications money may significantly slow things down unless it’s properly. Amazon and Twitter, two businesses with high reputations that you’ll only fantasize of having, have both pushed ahead with significant virtual currency initiatives this year.

The Central Bank’s Difficulty

Earlier in 2018, the Financial Stability Board published a report and research indicating that 80 percent of regional companies are engaged in bitcoin operation. Earlier, a game was conducted in the southeast City called Changzhou, which is located just northwest of Beijing, in which 100,000 people were each awarded 200 foreign currency (about $ 30) in a mobile currency. These individuals were urged to connect their blockchain technology to their financial institutions. However, if they were not utilizing their crypto tokens in the next few hours, it was removed from circulation – although both are excellent methods for future testing.