Key Takeaways

- Financial Independence, Retire Early (FIRE) is a growing movement in India, helping professionals break free from the 9-to-9 grind.

- A FIRE corpus in India can range from ₹75 lakhs (Lean FIRE in a Tier-2 city) to ₹10+ crores (Fat FIRE in metros) depending on lifestyle.

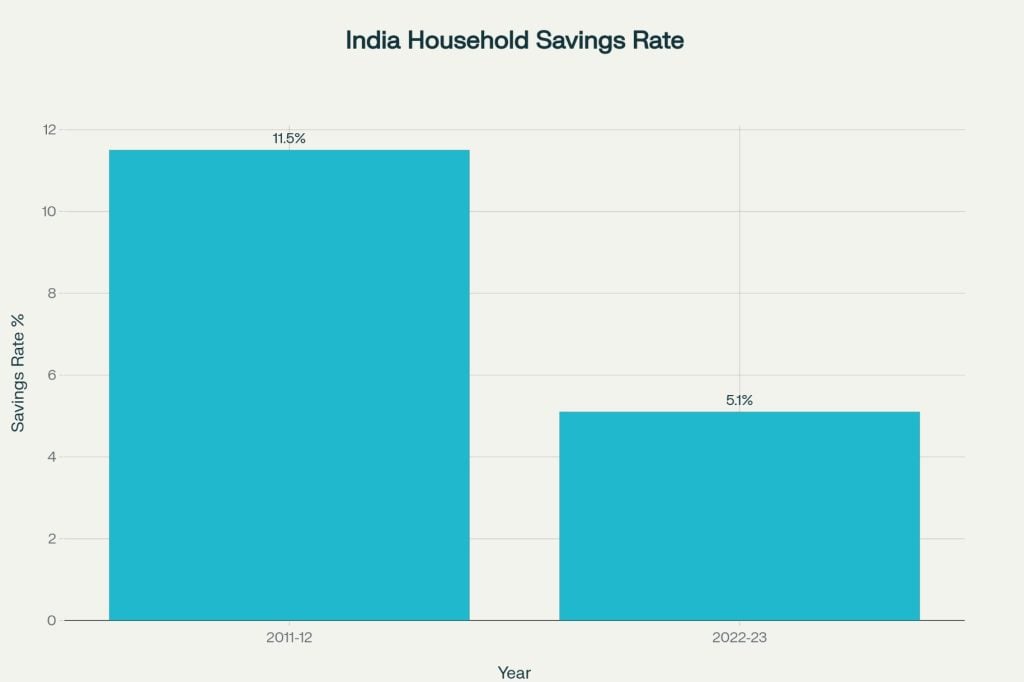

- Inflation is a bigger challenge in India than in the West. At 7% inflation, ₹1 lakh monthly expenses today can grow to ₹3 lakhs in 20 years.

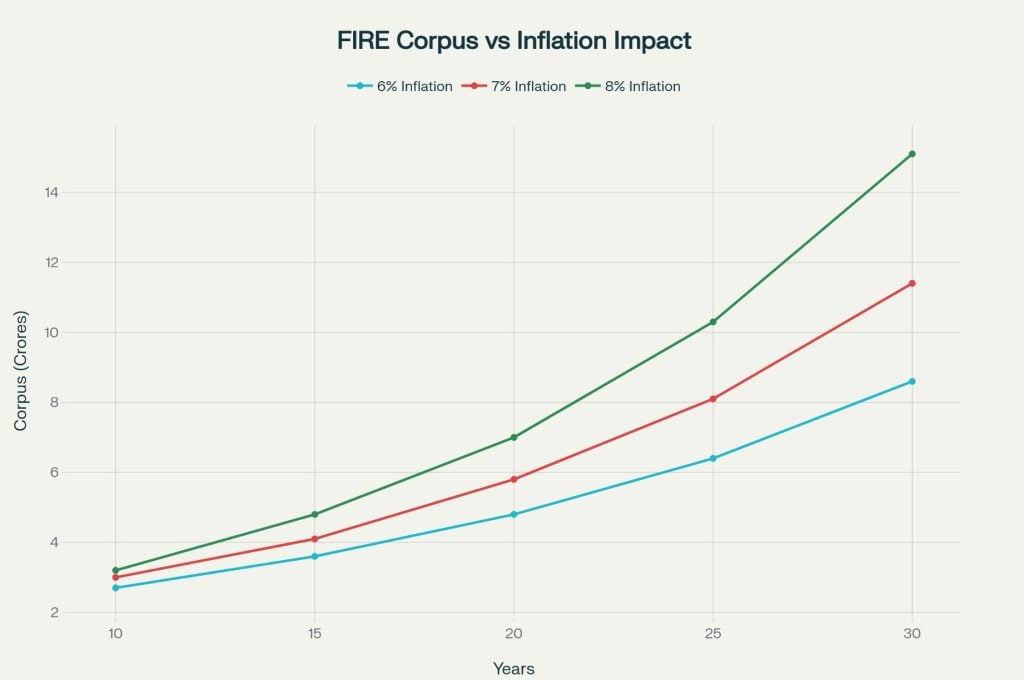

- Healthcare inflation (12–14%) is a ticking time bomb—medical costs can skyrocket by 5–10x within two decades.

- Equity investments (70–80%) and SIPs are crucial for beating inflation and building long-term wealth.

- Family obligations—supporting parents, children’s education, and weddings—make Indian FIRE harder but also unique.

- Geographic arbitrage (moving from a Tier-1 to a Tier-2 or 3 city) can slash costs by 30–50% without much lifestyle downgrade.

- Multiple income streams like consulting, rentals, and online businesses make FIRE safer and more sustainable.

- The future of FIRE in India looks promising as younger generations embrace financial independence earlier.

What is FIRE, and Why India is Talking About It

The idea of retiring in your 30s or 40s sounds like fantasy—until you realize thousands of Indians are actually doing it.

The FIRE movement began in the US in the early 1990s when authors Vicki Robin and Joe Dominguez published Your Money or Your Life. Their book preached a simple but radical idea:

- Earn more, spend less, invest wisely, and let compound interest free you decades before traditional retirement age.

By the 2010s, FIRE blew up globally thanks to bloggers like Mr. Money Mustache. Western millennials, tired of cubicles and commute, embraced minimalism, index funds, and financial discipline to escape the grind.

Now, India is catching up. Our cities are full of young engineers, consultants, and startup founders saying:

“Why work till 60 when I can retire by 40 and spend my evenings sipping chai in Goa or Ladakh?”

But India isn’t Silicon Valley. We have unique challenges (like inflation, healthcare inflation, and family obligations)—but also advantages (lower cost of living, growing equity markets, and family support systems).

India’s FIRE Advantage: Life Can Be Cheaper Here

Here’s the fun part: a comfortable middle-class lifestyle in India is often 3–5x cheaper than in the US.

Let’s put it in numbers:

Cost of Living: India vs USA

| Expense Category | USA (New York) | Mumbai (Metro) | Pune (Tier-1.5) | Indore (Tier-2) |

|---|---|---|---|---|

| 2BHK Rent | $3,500/month (~₹2.9L) | ₹1–1.5L/month | ₹35–60K/month | ₹15–25K/month |

| Groceries | $800/month (~₹66K) | ₹25–35K/month | ₹15–20K/month | ₹10–15K/month |

| Healthcare | $10,000/year (~₹8.3L) | ₹1–1.5L/year | ₹80K–1.2L/year | ₹60K–1L/year |

| Private School Fee (1 child, annual) | $20K (~₹16L) | ₹2–4L | ₹1–2L | ₹80K–1.2L |

| Lifestyle & Dining | $400/month (~₹33K) | ₹10–20K/month | ₹6–10K/month | ₹5–8K/month |

Takeaway: With ₹1 lakh/month, you can live like an upper-middle-class family in Pune or Kochi. Try that in Manhattan—you’ll probably end up sharing a studio with three roommates and a cat.

The Cultural Twist: Why FIRE in India is Harder

In the West, FIRE is about you. In India, it’s about us.

Think about it:

- You don’t just plan for your retirement, you plan for your parents’ medical costs (because “beta, tum hi sahara ho”).

- You don’t just save for your Netflix subscription, you also plan for your kid’s IIT or IIM fees, which can run into tens of lakhs.

- And yes, let’s not forget the Big Fat Indian Wedding—where even a modest function can set you back ₹20–50 lakhs.

This cultural factor is why Indian FIRE is not equal to Western FIRE. A 30-year-old in California can plan to FIRE with $1.2 million (~₹10 crores), but an Indian in Bangalore might need the same amount even though groceries cost one-third, simply because of family financial obligations and higher inflation.

Tip: Always add a 30–50% “family buffer” to your FIRE number. That way, you don’t end up eating Maggi while funding everyone else’s dreams.

The Math of FIRE in India

Now comes the fun (and slightly scary) part—the numbers.

The 25x rule is the global standard:

Your FIRE corpus = 25 × your annual expenses.

This works in the US because inflation is around 2–3%. But in India, inflation has averaged 6–7% in the last decade. Some years (like 2009, 2013, 2022), it has spiked to 8–12% .

So, Indian financial experts recommend the 30x rule instead:

FIRE corpus = 30 × annual expenses

This ensures your money lasts longer even if inflation is high.

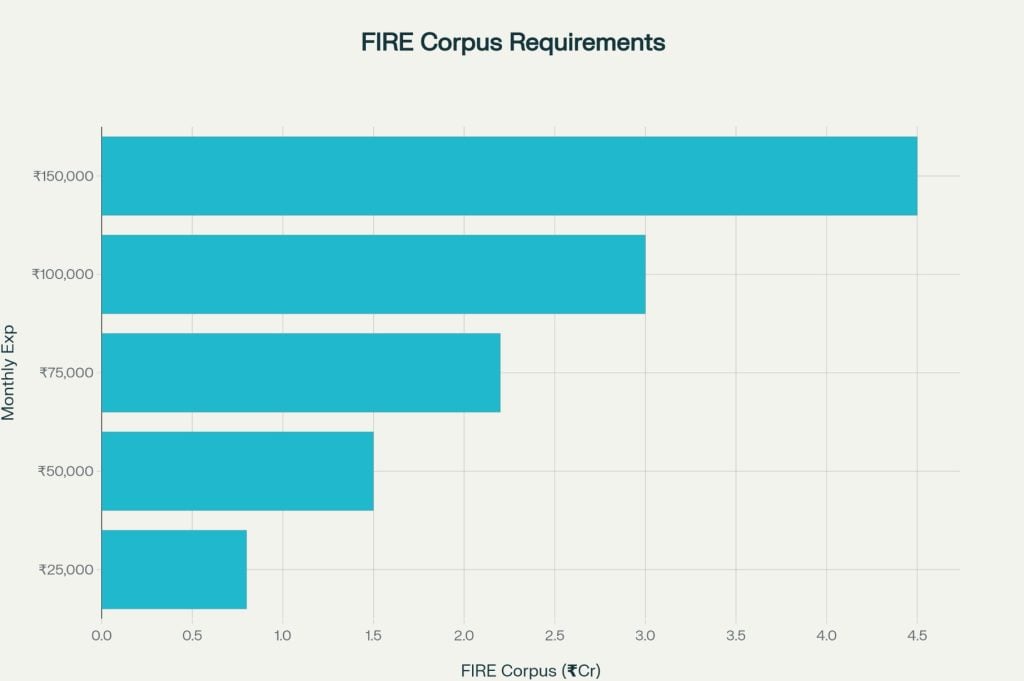

FIRE Corpus for Different Indian Lifestyles

| Lifestyle | Monthly Expense | Annual Expense | 25x Rule Corpus | 30x Rule Corpus |

|---|---|---|---|---|

| Lean FIRE (Tier-2/3 City) | ₹25K | ₹3,00,000 | ₹75L | ₹90L |

| Middle-Class Metro | ₹1,00,000 | ₹12L | ₹3Cr | ₹3.6Cr |

| Premium Metro | ₹1,50,000 | ₹18L | ₹4.5Cr | ₹5.4Cr |

| Fat FIRE (Luxury) | ₹2,50,000 | ₹30L | ₹7.5Cr | ₹9Cr |

| Ultra-Fat FIRE (Global lifestyle) | ₹5,00,000 | ₹60L | ₹15Cr | ₹18Cr |

Example: If your family spends ₹1 lakh/month, you need ₹3.6 crores (today’s value) to FIRE in India.

The Inflation Monster: Why Your Corpus Needs to Be Huge

Inflation is sneaky. It eats away at your money while you’re busy watching cricket highlights or waiting for Flipkart’s Big Billion Day sale.

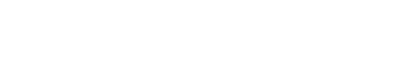

India’s retail inflation has averaged 6–7% in recent years .

How Inflation Eats Your Money

Let’s assume:

- Current monthly expenses = ₹1 lakh (₹12 lakh/year)

At 7% inflation:

- In 10 years → ₹23.6 lakhs/year

- In 20 years → ₹46.6 lakhs/year

- In 30 years → ₹92 lakhs/year

Now imagine you FIRE at 40 and live till 80. That’s 40 years of inflation. Your ₹3.6 crore FIRE corpus could shrink to half its real value in less than 15 years if not invested wisely.

Tip: Always aim for equities and growth assets during the accumulation phase. Your FD at 6–7% will barely beat inflation.

The Healthcare Time Bomb: Planning for Medical Costs

Here’s a fact that shocks most people:

- General inflation in India: 6–7%

- Healthcare inflation: 12–14%

That means your medical bills grow at double the pace of groceries.

Real-World Healthcare Cost Escalation

| Procedure | Current Cost (2025) | 2035 (12% inflation) | 2045 (12% inflation) |

|---|---|---|---|

| Heart Bypass | ₹3.5L | ₹11L | ₹34L |

| Knee Replacement | ₹2.5L | ₹7.8L | ₹24L |

| Cancer Treatment (full cycle) | ₹20L | ₹62L | ₹1.9Cr |

If your current medical expense is ₹50K/year, in 20 years it becomes ₹5.7L/year, and in 30 years, ₹19.6L/year.

Strategies:

- Buy a ₹20–25L health insurance cover early (premiums are lowest in your 20s and 30s).

- Add a super top-up plan for rare but catastrophic costs.

- Maintain a dedicated health corpus (15–20% of FIRE portfolio).

- Invest in health & fitness—walking daily is cheaper than dialysis.

Real-Life FIRE Stories in India

The Hyderabad Couple – Semi-Retired at 41

- Background: IT professionals in Bangalore, later moved to Hyderabad.

- Peak Income: ₹50 lakhs combined.

- Savings Rate: 45%.

- Corpus: ₹4.5 crores by 41.

- Annual Spend: ₹15 lakhs.

- Key Move: Relocating to a lower-cost city.

- Lesson: Location can accelerate your FIRE by years.

Mohit – The Bengaluru Engineer Who Hit ₹3.1 Crores by 39

- Salary: ₹35 lakhs at peak.

- Strategy: High SIPs, avoided lifestyle creep, invested in equities.

- Corpus: ₹3.1 crores by 39.

- Lesson: Consistency > high salary.

The Kochi Relocator – FIRE at 45

- Background: Former Bangalore IT professional.

- Corpus: ~₹3.5 crores.

- Expenses in Bangalore: ₹1.5L/month.

- Expenses in Kochi: ~₹80K/month.

- Lesson: Geographic arbitrage is India’s cheat code to FIRE.

Building a FIRE Portfolio in India

Why Equities Are Non-Negotiable

Equity markets are volatile, yes. But they’re also where real wealth creation happens.

- Nifty 50 CAGR (2003–2023): ~12%

- Sensex CAGR since 1980: ~15%

- Compare that with:

- FDs: 6–7%

- Gold: 9–10%

- Real Estate: 7–9%

👉 Without equities, your FIRE corpus will never beat inflation.

The Magic of SIPs

Systematic Investment Plans are the most beginner-friendly FIRE tool in India.

If you invest ₹50,000/month for 20 years at 12% CAGR:

- Future Value = ₹5.5 crores

If you invest ₹1 lakh/month for 20 years at 12% CAGR:

- Future Value = ₹11 crores

Tip: Increase your SIP by 10% every year. If you start with ₹50K and increase it by 10% yearly, you don’t just end with 5.5 crores—you could cross 8 crores.

Real Estate: The Indian Love Story

Every Indian parent says:

“Beta, pehle ghar kharido.”

And yes, owning your house is good—it removes rent (which grows 8–10% per year).

But real estate as an investment?

- Returns: ~8–9% CAGR

- Liquidity: Low (you can’t sell one bedroom if you need money).

- Costs: Maintenance, property tax, renovation.

Tip: Own one good house to cut rent. Beyond that, prefer equity + REITs for flexibility.

Gold: The Emotional Safety Net

Gold is India’s favorite asset—our moms treat it like the ultimate insurance.

- Average CAGR: 9–10%

- Acts as a hedge against inflation and currency devaluation.

- Easily liquidated in emergencies.

But don’t make gold your primary FIRE strategy—it’s a backup, not the hero.

Tax and Regulatory Landscape

Taxes in India can eat away at your FIRE dreams faster than your Zomato Gold subscription.

- Equity LTCG: 10% on gains above ₹1 lakh per year .

- Debt Funds: No more indexation after 2023 rule changes .

- PPF: Tax-free, but locked for 15 years.

- NPS: Extra tax benefit under 80CCD(1B), but mandatory annuity reduces flexibility .

- RBI inflation targeting: Keeps CPI inflation around 4% (±2%), but real inflation often runs higher .

Tip: Use a tax-advantaged cocktail → PPF + ELSS + NPS + Equity MFs.

FIRE Variations That Fit Indian Life

- Lean FIRE: Simple life in Tier-2 city, ₹75L–1.5Cr corpus, monthly spend ~₹25–50K.

- Fat FIRE: Luxury lifestyle in Mumbai/Delhi, ₹5–10Cr+ corpus.

- Barista FIRE: Quit main job but do consulting, freelancing, or teaching. Need only 50–70% of corpus.

- Coast FIRE: Invest heavily early, then let compounding do the heavy lifting. Example: ₹50L invested at age 25 @12% CAGR = ₹8Cr+ by 60 without further contributions.

Geographic Arbitrage: India’s Secret FIRE Weapon

Here’s where India shines. You can retire rich by moving cities.

Monthly Cost of Living by City (2025 Estimates)

| City | Housing (2BHK Rent) | Monthly Living Cost | Annual Expense (Family of 3) |

|---|---|---|---|

| Mumbai (Bandra) | ₹1.5L | ₹2L+ | ₹24–26L |

| Bangalore (Whitefield) | ₹80K | ₹1.5L | ₹16–18L |

| Pune | ₹50K | ₹1L | ₹12–14L |

| Kochi | ₹25K | ₹80K | ₹9–11L |

| Indore | ₹20K | ₹70K | ₹8–10L |

Moral of the story: Retiring in Indore with ₹3.5 crores can feel like retiring in Goa with ₹10 crores.

Common Mistakes in the Indian FIRE Journey

- Forgetting Inflation → That ₹1 lakh/month will become ₹3 lakhs in 20 years.

- Underestimating healthcare → One medical emergency can wipe out years of planning.

- Over-relying on real estate → Illiquid and maintenance-heavy.

- Not planning for kids’ education & weddings → Two big elephants in the room.

- Lifestyle creep → You don’t need the iPhone Ultra Plus Pro Max every year.

- No backup plan → Always keep a side income option.

Phased Roadmap to FIRE in India

Phase 1: Ages 25–35 – The Foundation Years

- Build skills, switch jobs, maximize salary growth.

- Save 50–60% of income.

- Build 6–12 months of emergency fund.

- Buy term life insurance + health cover early (cheap at this age).

- Start SIPs in index funds (Nifty 50, Sensex).

Phase 2: Ages 35–45 – The Acceleration Years

- Peak career growth years—maximize income.

- Increase SIP contributions by 10% every year.

- Pay off home loan, reduce debt.

- Plan for child education (PPF, Sukanya Samriddhi, mutual funds).

Phase 3: Ages 45–50 – The Optimization Years

- Reduce equity exposure from 80% → 60%.

- Build a healthcare corpus.

- Explore geographic arbitrage (consider Tier-2 cities).

Phase 4: Post-50 – The Withdrawal Years

- Stick to 3–3.5% safe withdrawal rule .

- Keep a mix of equity, debt, REITs, and fixed income.

- Maintain liquidity for emergencies.

- Focus on purposeful living—consulting, volunteering, travel.

The Future of FIRE in India

The next 20 years could be India’s golden era of FIRE. Why? Because a perfect storm of rising incomes, better access to investments, and shifting cultural norms is making financial independence more achievable than ever before.

Rising Incomes in Key Sectors

India’s IT, startup, and finance sectors are minting lakhs of new high-income professionals every year. According to recent reports, the average salary of a mid-level software engineer in India has risen to ₹8–15 lakhs per annum, while senior IT managers in Bengaluru or Hyderabad often make ₹30–50 lakhs annually .

And if you’re in specialized fields like AI, cloud computing, cybersecurity, or data science, the salaries are even higher—some crossing ₹60–80 lakhs in their 30s . That kind of income, paired with discipline, makes saving 50–70% possible, which is the backbone of FIRE.

Digital Finance Platforms: Investing is Easier Than Ever

A decade ago, investing in mutual funds meant signing forms, visiting branches, and filling out endless KYC paperwork. Today, platforms like Groww, Zerodha, Paytm Money, INDmoney, and Kuvera have made investing as simple as ordering a dosa on Swiggy .

- Direct mutual funds = lower expense ratios, higher long-term returns.

- Fractional investing = you can buy US stocks like Apple, Google, or Tesla with just a few hundred rupees.

- Robo-advisors & AI-based tools now help you pick and rebalance portfolios without needing a full-time financial advisor.

👉 You don’t need to be a finance nerd anymore. You just need an app, an internet connection, and the ability to resist panic-selling when Nifty dips 3%.

Changing Demographics: The NRI and Gen Z Factor

Two big demographic shifts are pushing FIRE forward in India:

- Gen Z & Millennials

- Unlike their parents, they don’t dream of working 40 years in one company.

- Side hustles (YouTube channels, freelancing, startups) are becoming the new normal.

- A 2025 survey found that 68% of Indians under 35 want to retire before 50 .

- NRIs Returning to India

- Many Indians work abroad (US, Middle East, Europe), earn in dollars, and retire in India.

- This is called geographic arbitrage: earning in a high-income country, spending in a low-cost country .

- Example: An NRI couple earning $200,000 in the US for 10 years and investing half could save ₹7–8 crores. Retiring in a city like Kochi with ₹1 lakh/month expenses becomes very achievable.

The Mental Shift: From Retirement to Financial Freedom

Here’s the most important part: FIRE in India is not just about not working.

Let’s face it—if you retire at 40 and do nothing, you’ll probably get bored by 42. What most Indians pursuing FIRE want is freedom:

- Freedom to say “no” to a toxic boss.

- Freedom to take a year off and travel the Northeast.

- Freedom to start a small café, blog, or even teach kids without worrying about money.

So, the future of FIRE in India is less about early retirement and more about early freedom.

Final Action Plan: Your Roadmap to FIRE in India

Alright, let’s bring all this together. If you’re serious about FIRE in India, here’s a step-by-step roadmap you can follow.

Step 1: Know Your Number

- Calculate your annual expenses.

- Add 30–50% extra for family, healthcare, and inflation.

- Apply the 30x rule.

- Example: If you spend ₹1 lakh/month (₹12 lakhs/year), your FIRE number = ₹3.6 crores today.

Step 2: Build the Foundation (Age 25–35)

- Focus on career growth—your income is your engine.

- Save at least 50% of your income.

- Build an emergency fund (6–12 months).

- Buy term insurance and health insurance early.

- Start SIPs in Nifty 50 or index funds.

Step 3: Accelerate (Age 35–45)

- Max out SIPs (₹50K–1L per month if income allows).

- Invest heavily in equities (70–80% allocation).

- Keep lifestyle inflation under control (a ₹30L car won’t make you happier, but a paid-off house will).

- Start child education fund early—PPF, Sukanya Samriddhi Yojana, or equity funds.

Step 4: Optimize (Age 45–50)

- Reduce equity allocation to 60–65%.

- Build a dedicated healthcare corpus.

- Consider moving to a Tier-2/3 city to cut costs by 30–40%.

- Explore REITs for stable rental-like income.

Step 5: Withdraw Smartly (Post-50 FIRE)

- Follow a 3–3.5% safe withdrawal rule.

- Keep some cash and debt for stability.

- Use dividends, rent, and part-time income to stretch your corpus.

- Focus on meaningful work—consulting, teaching, mentoring, writing.

Conclusion

The FIRE movement in India is no longer just a dream—it’s becoming a reality for thousands of professionals. But unlike the US, where people only plan for themselves, Indians must account for family obligations, higher inflation, and skyrocketing healthcare costs.

A realistic FIRE number in India ranges from ₹75 lakhs (for frugal, small-town living) to ₹10+ crores (for luxury metro lifestyles). The smart path to FIRE in India combines:

- Aggressive saving (50–70% of income)

- Equity-focused investing to beat inflation

- Healthcare planning with insurance + a medical corpus

- Geographic arbitrage to stretch your rupee further

- Multiple income streams for resilience

Ultimately, FIRE in India isn’t just about quitting your job. It’s about taking control of your time—so you can spend it on what really matters: your family, your health, your passions, and maybe that dream of running a beach café in Goa.

The road is long, but if you start early, stay disciplined, and plan smartly, you really can retire early in India—on your own terms.

References

- Indian Institute of Banking & Finance – BankQuest Journal, Oct–Dec 2024

- ET Money – “F.I.R.E Method: What is it & how to secure retirement?”

- Deepak Pincha, LinkedIn – “FIRE Movement in India: Can You Retire Early?”

- ClearTax – Retirement Planning Calculator

- Jiraaf – Retirement Planning Blog

- Scripbox – FIRE Movement in India

- Press Information Bureau – RBI Inflation Forecast, 2025

- DD News – RBI reduces inflation forecast for 2025–26

- IJFMR – Healthcare Inflation Study in India

- Economic Times – PGIM India on medical inflation

- Times of India – Retirement planning mistakes to avoid

- Business Today – “FIRE Movement in India: Financial Independence, Early Retirement” (2025)

- Reddit – FIRE India case studies

- Reddit – “How my colleague achieved FIRE at 45”

- FreeFincal – Abhishek’s FIRE journey with 20x corpus

- Moneycontrol – Large Cap Fund Returns

- Moneycontrol – Mutual Fund Finder

- Star Estate – Real Estate Investment & Retirement

- L&T Realty – Real Estate Investment in India

- GripInvest – Financial Independence Retire Early in India

- PhysicsWallah Careers – IT Salary in India (2025)

- UpGrad – Average IT Engineer Salary in India (2023)

- Coursera – Software Developer Salary Report

- CEIC Data – India Gross Savings Rate

- Deccan Herald – “Debt and the Collapse of Middle Class Dreams”

- Next IAS – India Household Savings 2025

- Business Today – “Rising Costs, Falling Savings: India’s Middle Class”

- Reddit – “Is ₹1 crore enough to retire early in India?”

- Reddit – “In a world obsessed with FIRE, is it time we rethink?”

- PGIM India – Retirement Readiness Survey 2020

- Moneycontrol – “Rethinking Real Estate in India”

- Moneycontrol – India Inflation Rate

- Trading Economics – India CPI Inflation

- PNB MetLife – FIRE Planning Guide India

- Spring Money – FIRE Calculator India

- Groww – Retirement Calculator

- Groww Blog – Personal Finance Books

- SP Jain Blog – “FIRE Movement in India: Redefining Work & Retirement”

- PIB – India GDP Growth Outlook 2025–26