Besides New Year’s resolutions you can actually make, you can actually do these New Year’s resolutions on personal finance. Here are a few easy-to-follow ideas for the New year!

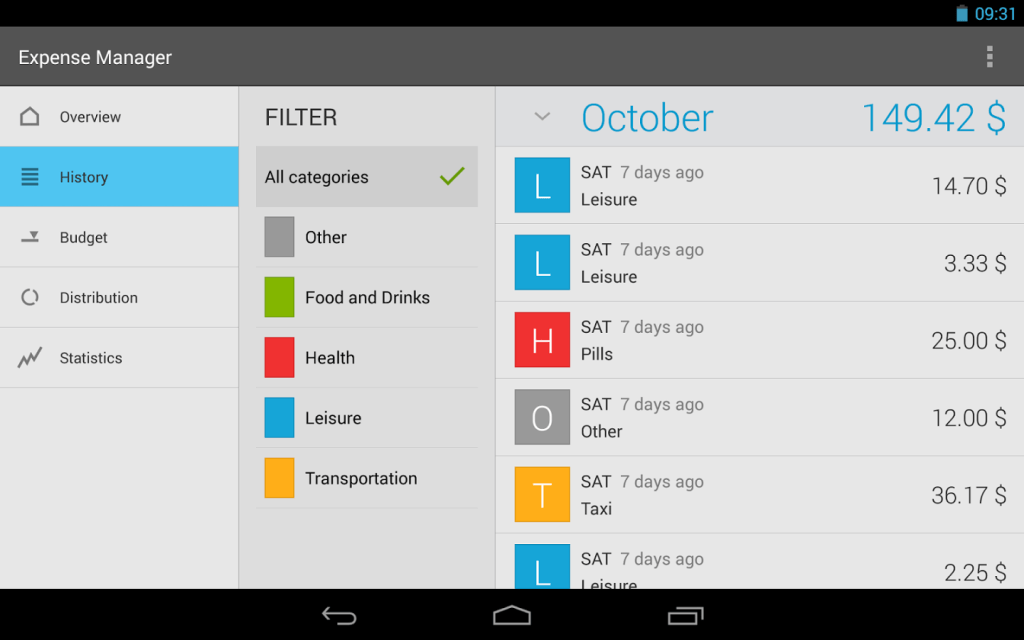

#1 Design a livable budget

The key to the success of most dieters is monitoring everything you eat (to get some surprising diet rules, click here). You can apply this same approach when you design a livable budget. If you have no idea where to start, look for a free budget calculator online to help you with the skeleton of your livable budget.

#2 Take note of your expenses for one month

In one month, take note of each and every expense, whether it may be food, rent, fuel, clothing, cable, insurance, entertainment, and the like. This will give you a better grasp of how to adjust your livable budget accordingly.

#3 Begin to pay off your debt

This tip is actually included in these easy-to-follow tips for saving money. Begin by paying down your debts. Make a list of all your outstanding debt balances and their corresponding interest rates. Afterwards, for each month, pay the minimum amount due for each account. However, pay as much as possible on the account or loan with the highest interest rate.

#4 Build an emergency fund

Begin by building an emergency fund. Start gradually with a few dollars per month. For instance, put aside $1 per day for a month. Afterwards, double that amount to $2 each month. Double that again a month later to increase your pattern. You can look online for an Emergency Fund calculator to check how much you require to put aside for your fund.

#5 Think about the future

Tap into your more sound budgeting and credit management skills if you want to buy a home and pay for college and retirement, since these are all big-ticket items.

#6 Create multiple sources of income

Of course we don’t mean getting into multilevel marketing schemes. Those things just don’t work (they seem to in the beginning, but eventually dissipate). If you have a regular job, turn a hobby or industry knowledge into freelance work or side gigs. Another thing is to sell your unwanted items on eBay or even your creative works on Etsy. Just remember to still do your day job well, as you pursue these other income streams.

#7 Cut corners

Although saving is a popular resolution, it is too vague. Go through your accounts, statements, checkbooks, etc. and see where you can cut corners. You can also get an energy audit to lower your power bills or an insurance audit to check if you are overpaying or refinancing a mortgage. Moreover, there are a lot of websites like DailyFinance that provides practical tips to save on your regular expenses.

#8 Educate yourself

Remember, no one can take your education away from you. Invest in yourself and take classes. This can get you a raise, a better job, and make you a better saver and investor.

#9 Make it convenient for yourself

Make it more convenient for yourself by setting up automatic bills payment and automatic withdrawals. This can assist you in reaching your financial goals.

#10 Live below your means

This is a great resolution for everybody. There are actually many people who live beyond their means for 30-some years. People who have been earning $300,000 or more since 2008 can experience a more serious fall when something catastrophic occurs in their lives. For instance, even if you can buy a Mercedes Benz, choose to buy a lower-priced automobile.

#11 Consolidate your credit card debt

Any person who has difficulty in paying their credit card debt can ask for credit counseling, to alter the way they are spending and earning. Through debt consolidation, you can lower your interest rates.

#12 Quickly divide unexpected income

When you receive unexpected income or a windfall, like extra cash for extra work, a gift, or a bonus, use the rule of thirds to use. A third for the past, for example to pay the debt you owe; a third for the future, which you can use for some investment or savings; and another third for the present, like a personal or home improvement that you like. With this, your debt shrinks, your savings increase, and you don’t feel deprived!

#13 Leave your ATM card at home

We always tend to make impulse purchases. To stop your bank account numbers from getting smaller and smaller, leave your ATM card at home or if you’re a bit more adventurous, cut it! It’s simply too easy to get money anywhere at anytime. Just calculate how much money you’ll need each week for your usual cash-based expenses, go to your bank, and withdraw the money you need for that week. Since you only have a minimal amount of money with you, you’ll probably think twice before you buy something.

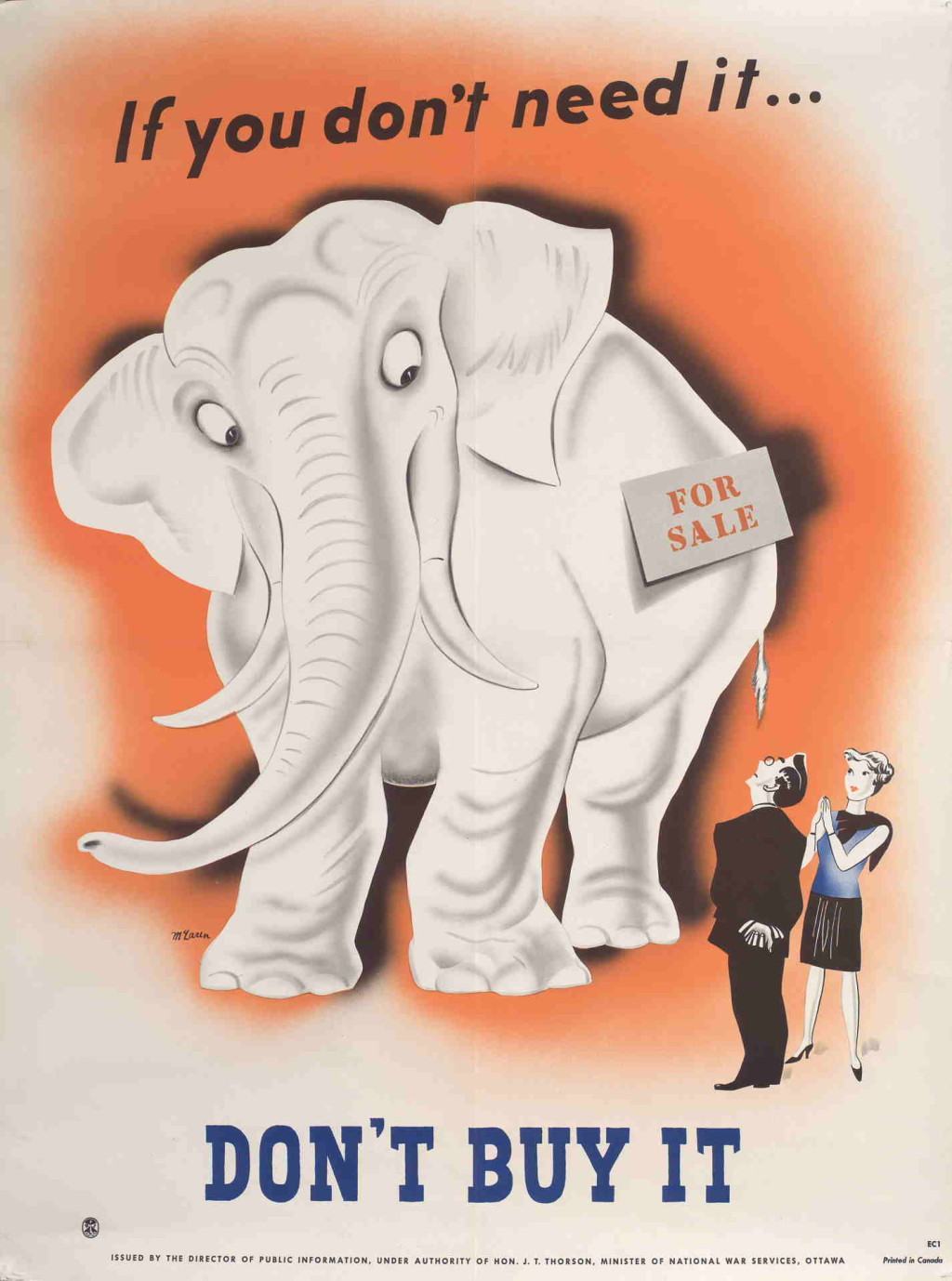

#14 Don’t buy it if you can’t pay for it

Don’t go buy something on credit, that is, if you don’t know how you’re going to pay for it. It’s not particularly bad if you charge something on a credit card or get a loan, but it is bad if you don’t have a repayment plan that is not realistic.

#15 Start the little ones early

To get into a virtuous cycle, if you have kids, or even nieces and/or nephews, talk to them about money. Even a 4-year-old can understand between wants and needs, savings and expenses, etc.

H/T: boredbug