We live in a world where the main aim is financial stability because we deal with hard times and inflation. In a recent study of CEO:

“Around 56% of CEOs emphasized the need for operational planning and flexibility.”

The future of the business has arrived sooner than expected; that’s why we need to change our challenges and priorities. According to studies, financial and operational planning are vital parts that play a crucial role in a company’s performance. Apart from this, it helps to build an organizational future and helps to deal with uncertainty. But if you want to adopt this, then start learning from the basics:

What is financial and operational planning?

Operational planning is a written document describing any company’s nature, sales, and marketing strategy. All these factors play an optimal role in the success and provide an organization with a vision, direction, and goals. On the other hand, in financial planning, an organization allocates the budget to meet the operational planning. An operational plan isn’t only meant to secure finance, but it’s an excellent step to running your business successfully. However, with the help of these strategies, you can create products and services that will make a unique space in the marketplace.

Types of operational business planning

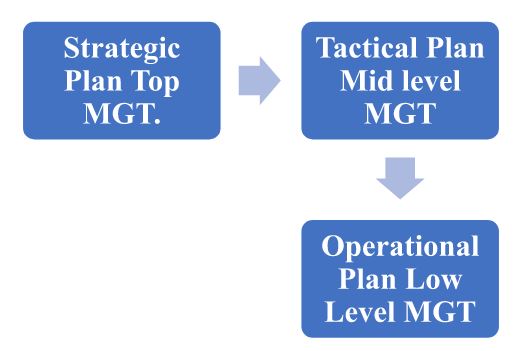

To fully understand operational business planning, the first step is to look at all three levels. So, there are the following levels of operational business planning:

In a strategic plan, the organization focuses on future goals and ambitions on a broad and general level. The tactical plan sees the business as a whole and works explicitly towards actions and ideas. Moreover, an operational plan for low-level management is an entire organization. The operational plan focuses on the activities and tactical programs in detail. In addition, it includes work schedules, policies, rules, and regulations that set the standards for employees’ work ethics.

How to adopt an excellent operational and financial planning strategy?

An effective strategy focuses on business survival and growth. Apart from this, it involves change, planning, organizing, controlling, and monitoring. So, to achieve all these goals, you must allocate financial resources equally. But if you are new, first read strategic management for startups that help grow and scale business. Earlier, we discussed that financial and operational planning helps improve an organization’s financial health and ROI. Here are ways to help you adopt good financial and operational planning.

Review the strategic plan of your organization

Financial planning is your company’s strategic plan. However, the main goal is to accomplish all the tasks and financial goals on time. Here are the few questions that you should ask yourself before making a strategic plan:

- Do I need to expand my business?

- What is the updated equipment that I need for my business?

- How can I improve business processes?

- How to make a perfect cash flow plan?

- How much finance do I need?

- Do I need to hire more staff?

In this way, you can determine the impact of this plan in the next 12 months. Later, you can decide about the projects where you need to spend more or make changes.

Make the financial projections

Before making any strategy, it’s vital to make a financial projection. You can record anticipated income, labor expenses, supplies, and overhead costs. There are many tools and software that you can use for prediction. But don’t ever assume that sales will turn into cash flow instantly; that’s why you should plan accordingly. Additionally, use automation software like paystub generator to align the payroll expenses.

Always be prepared to respond to change

Once the plan is shared and adopted, it’s critical to measure its success. The success should align with the objectives and organizational goals. However, you can set a benchmark and compare the results to judge the progress. This way, you can respond quickly if there is any need to change the plan. Thus, if there is a need to change the strategy, then follow these steps:

| Monitor benchmarks to track the effectiveness of the strategic plan |

| Track the assumptions after regular interval |

| Cancel projects that are underperforming than standard |

Later, you need to agree upon a new plan and take specific steps to increase the chances of success.

Consider terms to determine operational plans

There are many types and categories of business operational plans. So, there are a few that you must determine to achieve good results:

- Clear objectives

- Deliver progress actively

- There should be quality standards

- Budgeting is crucial

- Take care of procedures

- Always seek desired outcomes

All these terms are broad and determine the overall operational plans of a business. But an organization should focus on goals, objectives, and company needs. In this way, your company can also strive in harsh conditions.

Assess your capabilities by setting measures

The key to success is to execute action plans on time. In this way, you can assess the strengths and weaknesses on time. The best way to evaluate capabilities is by setting the measures and metrics. Both terms are different:

- An effort is an observable business outcome

- A metric describes actual data that is collected to quantify the measure

But make sure that metrics are measures that represent a range of data. For instance, you need to focus on everything from customer satisfaction to measuring engagement.

Learn more

As a business runner, you must be prepared to adapt to change, rapid advancement, and multiple work environments. In this way, you can minimize overhead costs and improve business processes. However, it’s only possible if you are flexible and ready to learn more. For instance, many businesses moved online during the pandemic, and only those who got the success were open to change. Moreover, you can have everything at your fingertips with the right financial and automated operational tools. This way, the stakeholders and partners consider themselves part of the business and decision-making process. But the golden rule is NOT TO PANIC and make wise decisions that are good for the well-being of your business.