There is a new intensity in Sachin Bansal when he speaks. The geek-looking CEO of Flipkart, India's biggest online retailer by revenues, gets unusually forceful making the point that he is looking for global talent to scale up his dream. "We want to hire every good person who comes our way. We are ramping up the number of tech people we have. We are looking to hire not just in India, but from outside as well," says the 32-year-old, less than 12 hours after returning from a trip to the US, where he met technology leaders at Google, LinkedIn, and Twitter to "exchange ideas".

Flipkart has almost one-fifth share of the online retail market in India.

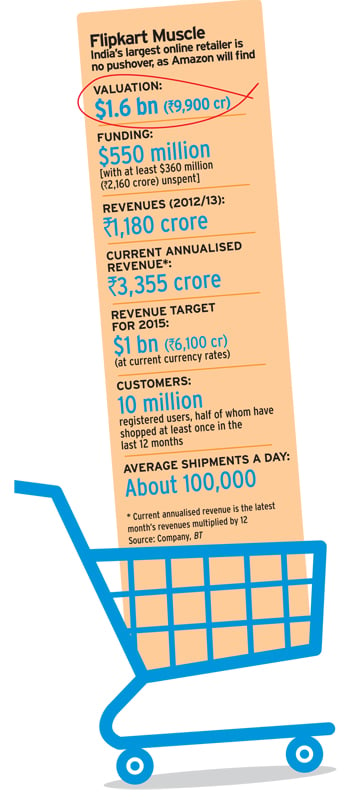

He will not agree to this cause-effect association, but the energy levels at Bangalore-headquartered Flipkart are definitely linked to the entry of Amazon, the world's biggest online retailer, into India last June. Though Amazon is not offering its own retail services here because regulations don't permit that and has instead set up a third-party marketplace that hundreds of retailers sell on, the message is clear: the big daddy of online retail is here – virtually in Flipkart's backyard. Amazon India's office is just 13 km from Flipkart's in Bangalore. With its expertise of nearly two decades and deep pockets (it is expected to close 2013 with more than $70 billion in revenues), the Jeff Bezos company is the strongest competitor Flipkart (annualised revenues: $550 million) will fight for supremacy in India.

A credible rival can do wonders to an enterprise and Flipkart is no different. A month before Amazon launched its marketplace in India under the Amazon.in name, Flipkart launched its version of the marketplace. In July, it first announced its payments brand PayZippy for online merchants and customers seeking fast, hassle-free and safe payment options. Given the critical mass of transactions Flipkart controls – about 100,000 a day – the company is betting that it has the volumes to lay the foundation of what will be a profitable business. It is much like how Amazon bet on web server and storage services and made a successful business out of it. In December, Flipkart launched a one-day guaranteed delivery service, just five days after Amazon.in announced it.

The two companies are in the same business and there will be similarities in the services or features each launches. Bansal shrugs off competition from Amazon – his and co-founder Binny Bansal's former employer. "I think it's a good thing. It makes things more interesting. We've been very aggressive on growth, irrespective of Amazon's entry. We're not a very competition-focused company," says Sachin. What bothers him more is something different: "Whatever we are doing today is very insignificant compared to what will be required to do by 2020. "

The two companies are in the same business and there will be similarities in the services or features each launches. Bansal shrugs off competition from Amazon – his and co-founder Binny Bansal's former employer. "I think it's a good thing. It makes things more interesting. We've been very aggressive on growth, irrespective of Amazon's entry. We're not a very competition-focused company," says Sachin. What bothers him more is something different: "Whatever we are doing today is very insignificant compared to what will be required to do by 2020. "

That is a fairly accurate assessment. Says Ashish Gupta, Senior Managing Director at venture capital firm Helion Venture Partners: "The story has just begun." The size of online retail as a percentage of the overall retail market is predicted to grow to seven per cent, or some $61 billion, by 2023, from just 0.2 per cent, or $1 billion, today, says consulting firm Technopak.

Flipkart is estimated to have a one-fifth share of the online retail market in India – how does it plan to hold that share? One is expand logistics, a core strength where big investments and technology helped Flipkart become the gold standard in delivery in India. Flipkart ships books to almost all of India's 21,000 PIN codes and covers over a hundred cities for its entire product portfolio of 20 categories like consumer electronics, office supplies, watches, and health and beauty products. Some 70 per cent of its shipments are done by its own logistics company and about half of deliveries are on a "cash-on-delivery" basis. "Having your own logistics can pay off as we scale; the benefit will come to us rather than to a logistics company," says Sachin. He looks at China with a logistics network covering 2,000 cities and towns as an example to emulate. "That means reaching out to a 1,000-people (location). That's an area of improvement for e-commerce in general and for Flipkart as well," he adds.

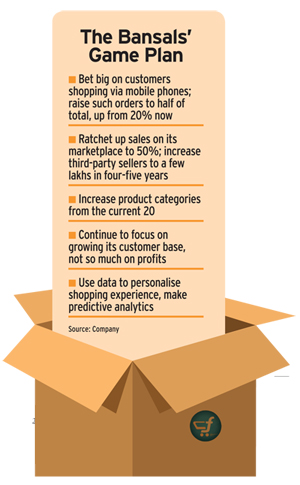

For Flipkart, there is no option but to expand fast across categories to add choice for customers. "The wider the range of things you sell, the more people expect from you. You also need to show depth in categories," says Helion's Gupta. Flipkart is now betting big on the marketplace model for growth which is a very attractive proposition for horizontal players who want to expand fast across products and categories without dramatically increasing fixed costs. The target: 10,000 to 15,000 resellers in a year, up from the current 1,000. "We have learnt a lot in the last eight months about the ecosystem and what technology platforms are required to scale up the business. In the long term, we see more than half of our business coming from third-party sellers," says Sachin.

Flipkart wants to expand its presence in fashion and apparel that promise average margins of 20 to 30 per cent, compared to categories such as electronics that promise less than half those levels of margins and hardly cover shipment charges. Online sellers with a big presence in fashion attract a higher number of visitors, too. Myntra, for instance, clocked over 24 million unique visitors in December and Jabong nearly 20 million, as per data from online tracker comScore. Flipkart, despite being a broad-category seller, in comparison, recorded 13.22 million uni- que visitors. (Sachin says the Flipkart number is inaccurate, but declines to disclose in-house numbers.)

[quote align=”left”]Myntra clocks over 24 million unique visitors and Jabong 20 million.[/quote]But as the market matures further, focusing only on acquiring new customers and increasing categories is not going to be enough. Customer stickiness is something to worry about. "Using cutting-edge analytics to offer loyalty bonuses or offering products not available elsewhere will be an important strategy going forward," says Arvind Singhal, Chairman, Technopak. Sachin is well aware of this. "Flipkart is good place to shop, if you come on the site knowing what you want to buy already. There is a bigger market opportunity waiting for us if we are able to induce or seed the purchases, affect purchasing behaviour and our ability to recommend," he says.

For instance, recommending a phone case to someone buying a Google Nexus 5 phone is common, but presenting a premium leather case or a functional plastic one based on past purchase patterns will decide the margins on the purchase. The holy grail for Flipkart lies at the intersect of "personalised experience" and "predictive analytics", clearly. Add PayZippy to that mix and Flipkart could be sitting on something that differentiates it from competition. Says M.N. Srinivasu, Director, Billdesk, a payments company: "Processing its own transactions can give Flipkart crucial analytics on consumer behaviour and help improve stickiness."

Like Amazon and others, Flipkart believes customers coming to shop via mobile phones will be big. "More than 40 per cent of traffic (on Flipkart) today comes from mobile, whether on apps or on our mobile website. It is quite a bit of change from one year ago when it was a single-digit percentage," says Sachin, adding that in categories like clothes and shoes, the orders on mobile phones are more than those made from desktops. Increasing overall order volumes made from mobile phones to half from one-fifth today, however, will take a year or two.

Like Amazon and others, Flipkart believes customers coming to shop via mobile phones will be big. "More than 40 per cent of traffic (on Flipkart) today comes from mobile, whether on apps or on our mobile website. It is quite a bit of change from one year ago when it was a single-digit percentage," says Sachin, adding that in categories like clothes and shoes, the orders on mobile phones are more than those made from desktops. Increasing overall order volumes made from mobile phones to half from one-fifth today, however, will take a year or two.

The big question before those looking at Flipkart from a cash- flow point of view is how long it will be able to fund losses especially given its strategy to focus on growing its customer base rather than pull in profits. "Out of a crore people that shop online, very few think of online as a primary medium yet. We are currently more focused on delighting the customer and getting more and more people to shop online," says Sachin. Flipkart backers, too, are not worried of its high cash burn.

"Amazon burnt loads and loads of capital before even breaking even. A transformational change needs loads of capital," says Abhishek Agrawal, Managing Director at Seattle, US-based Vulcan Capital, an investment firm founded by Microsoft cofounder Paul Allen, that was part of a recent $360-million funding round at Flipkart.

Nor does growing competition bother Agrawal. "Amazon has not been able to dent local guys in any of the BRIC countries, whether it is Russian giant Ozon or Alibaba in China. I'll be very surprised if the story is different in India." Predicts Technopak's Singhal: "India will have five to six dominant players. That will include Amazon."[quote align=”right”]More than 40% of traffic on Flipkart today comes from mobile.[/quote]

Experts predict a consolidation among online retail companies this year as private equity investors are stepping in to fund an estimated $2 billion to $4 billion required by the industry in the next three to four years. Even so, investments in the $150 million to $200 million bracket will not be easy to come by till regulatory changes allow foreign investment in e-commerce. In other words, Flipkart may find it difficult to get more private cash. "The next best thing to raising private capital in the next two to three years will be to list themselves, something like what MakeMyTrip did with its NASDAQ listing," says Mahendra Swaroop, Managing Director at private equity firm Avigo Capital.

Sachin dismisses any concern over cash, saying Flipkart remains focused on customer growth and the brand. In internal meetings, he often sets the bar high: Flipkart "should be something that you are able to recommend to your mother and feel comfortable that it will not be a bad experience". With $360 million in hand – and Amazon.in gaining ground – the do-or-die years are ahead of Flipkart, not behind.

[divider scroll_text=”Back To Top”]