Investing in mutual funds has long been a popular way for individuals to gain exposure to a diversified portfolio of stocks, bonds, and other securities. However, as the markets become increasingly complex and the number of available funds grows, it can be difficult to make informed investment decisions. This is where AI-powered insights come in. By leveraging sophisticated algorithms and machine learning techniques, investors can gain crucial insights into market trends and make more informed decisions.

Understanding Mutual Funds and AI-Powered Insights

Before delving into the benefits of AI-powered insights for mutual funds, it’s important to first understand what mutual funds are and the role of AI in finance.

What are Mutual Funds?

Mutual funds are investment vehicles that pool together money from a group of investors to invest in a diversified portfolio of stocks, bonds, and other securities. They are managed by professional fund managers who make investment decisions on behalf of the investors based on the fund’s investment objectives.

Investing in mutual funds is a popular way for individual investors to gain exposure to a diversified portfolio of assets without having to make individual investment decisions. Mutual funds offer the benefits of diversification, professional management, and liquidity.

There are different types of mutual funds, including equity funds, bond funds, money market funds, and balanced funds. Equity funds invest primarily in stocks, while bond funds invest primarily in bonds. Money market funds invest in short-term, low-risk securities, while balanced funds invest in a mix of stocks, bonds, and other securities.

The Role of AI in Finance

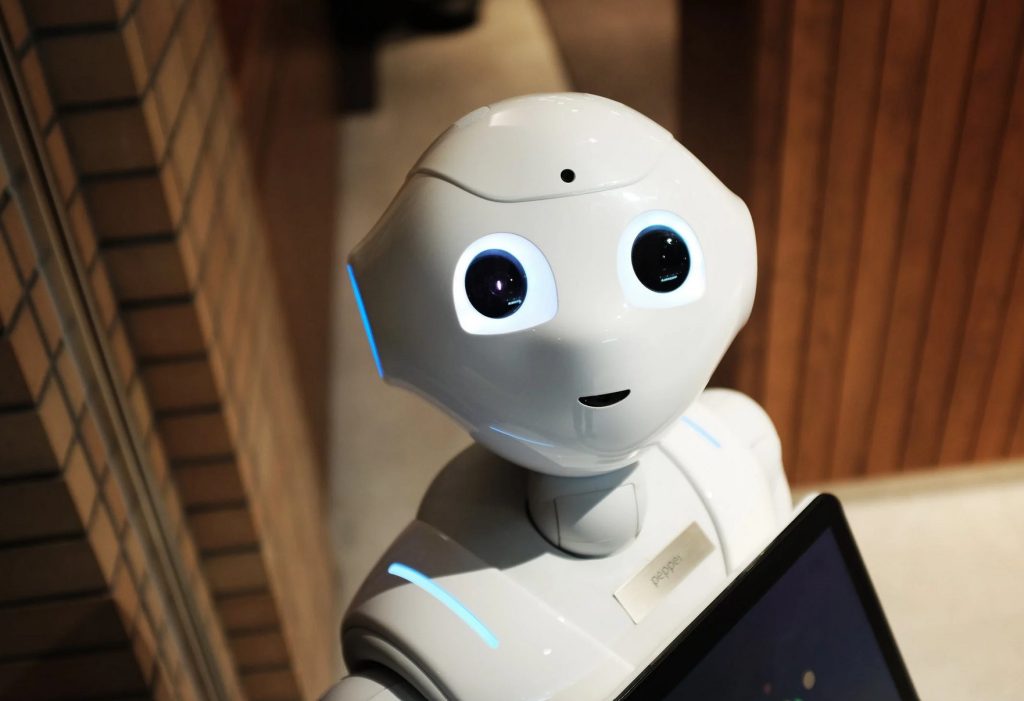

AI, or artificial intelligence, refers to the use of computer algorithms and machine learning techniques to automate decision-making processes and gain insights from data. In finance, AI has the potential to revolutionize the way investment decisions are made, by analyzing vast amounts of data and identifying patterns or trends that can inform investment decisions.

AI-powered insights can be particularly useful in the context of mutual funds, where fund managers are tasked with making investment decisions on behalf of a large group of investors. By leveraging AI algorithms, fund managers can gain insights into market trends and identify investment opportunities that may have been overlooked using traditional investment analysis techniques.

Benefits of AI-Powered Insights for Mutual Funds

The benefits of AI-powered insights for mutual funds are numerous. By analyzing historical market data, AI algorithms can identify patterns and predict future market trends with a high degree of accuracy. This can inform investment decisions and lead to higher returns for investors.

Moreover, AI can help fund managers identify anomalies or outliers in financial data that may be indicators of risk or opportunity. By identifying these outliers, fund managers can take proactive steps to mitigate risk or take advantage of investment opportunities.

AI-powered insights can also help fund managers optimize their investment portfolios by identifying the optimal mix of assets based on the fund’s investment objectives and risk tolerance. By optimizing the portfolio, fund managers can maximize returns while minimizing risk for investors.

In the realm of mutual funds, quantumaitrading.net provides powerful AI-powered insights for investors. By leveraging quantum computing and advanced algorithms, it enhances data analysis and decision-making processes. Quantum AI enables investors to navigate complexities, evaluate risk, and optimize portfolio management, maximizing returns in the dynamic world of mutual fund investments.

Overall, AI-powered insights have the potential to transform the way mutual funds are managed, leading to better investment decisions and higher returns for investors.

AI-Driven Tools for Mutual Fund Analysis

There are several key tools and technologies that are driving AI-powered insights in the mutual fund industry. These include robo-advisors, AI-powered portfolio management, and sentiment analysis and market prediction.

Robo-Advisors

Robo-advisors are automated investment platforms that use AI algorithms to make investment decisions on behalf of investors. They typically ask investors a series of questions to determine their investment objectives and risk tolerance, and then use this information to build customized investment portfolios. Robo-advisors can provide investors with a low-cost, easy-to-use investment solution, and often outperform human financial advisors.

AI-Powered Portfolio Management

AI-powered portfolio management involves the use of machine learning algorithms to analyze vast amounts of financial data and make investment decisions based on that data. This can lead to more informed investment decisions and higher returns for investors. AI-powered portfolio management also allows for greater personalization of investment strategies, as algorithms can be customized to individual investor needs and preferences.

Sentiment Analysis and Market Prediction

Sentiment analysis and market prediction algorithms use natural language processing and machine learning techniques to analyze news articles, social media posts, and other sources of market data for indications of investor sentiment. This can provide valuable insights into market trends and potential investment opportunities or risks.

Enhancing Investment Decisions with AI

AI-powered insights can enhance investment decisions in several key ways. These include improved risk assessment, personalized investment strategies, and real-time market monitoring.

Improved Risk Assessment

AI algorithms can analyze vast amounts of financial data to identify patterns and indicators of risk in investments. This can help fund managers make more informed investment decisions and reduce the risk of losses for investors.

Personalized Investment Strategies

AI-powered insights can be customized to individual investor needs and preferences, allowing for greater personalization of investment strategies. This can lead to higher returns and greater investor satisfaction.

Real-Time Market Monitoring

AI algorithms can provide real-time monitoring of market trends and indicators, allowing for quick reaction times to market shifts. This can help fund managers adjust investment strategies and minimize losses for investors.

Overcoming Challenges in AI-Driven Mutual Fund Management

While AI-powered insights offer many benefits to mutual fund management, there are also several challenges that must be overcome. These include data privacy and security, regulatory compliance, and ensuring AI transparency and explain-ability.

Data Privacy and Security

The use of AI algorithms requires access to vast amounts of financial data, which can raise concerns about data privacy and security. It is important for fund managers to ensure that adequate measures are in place to protect investor data and prevent data breaches.

Regulatory Compliance

The use of AI algorithms in mutual fund management must comply with regulatory standards, including those set by the SEC and other governing bodies. Fund managers must ensure that their use of AI algorithms meets these standards and does not violate any laws or regulations.

Ensuring AI Transparency and Explain-ability

AI algorithms can be complex and difficult to understand, which can lead to a lack of transparency and explain-ability in investment decisions. Fund managers must work to ensure that their use of AI is transparent and explainable to investors, to build trust and confidence in the decision-making process.

Conclusion

AI-powered insights offer many benefits to mutual fund management, including improved investment decisions, personalized investment strategies, and real-time market monitoring. These benefits must be weighed against the challenges of data privacy and security, regulatory compliance, and ensuring AI transparency and explain-ability. By carefully balancing these factors, mutual fund managers can leverage the power of AI to navigate the complex world of investing and generate higher returns for investors.