As global markets become more accessible, many companies are eyeing the United Kingdom as a prime location for their 2025 expansion plans. With its business-friendly environment, strong legal framework, and vibrant economy, the UK continues to be an attractive destination for overseas businesses. However, one critical decision companies must make early on is whether to establish a branch or a subsidiary.

Both structures allow foreign companies to operate in the UK, but they differ significantly in terms of legal status, liability, taxation, regulatory obligations, and operational flexibility. Choosing the right option can affect not just your market entry but also your long-term success. Let’s dive into the differences between a branch and a subsidiary and explore which one might suit your business best.

Understanding the Basics: What Is a Branch? What Is a Subsidiary?

Before we explore the advantages and disadvantages, it’s crucial to understand what each term means:

- Branch: A branch is simply an extension of the parent company. It does not have a separate legal identity from its parent; instead, it operates on behalf of the parent company in the UK. Setting up a UK branch of overseas company requires registering with Companies House and complying with some local reporting obligations. However, the parent company remains directly responsible for the branch’s activities, debts, and liabilities.

- Subsidiary: A subsidiary, on the other hand, is a separate legal entity from the parent company, even though it may be wholly owned or controlled by it. In the UK, subsidiaries are often incorporated as private limited companies (Ltd). This structure provides a clear legal separation, meaning the parent company is not automatically liable for the subsidiary’s actions or financial obligations.

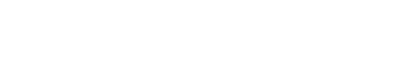

Key Differences Between a Branch and a Subsidiary

Here’s a side-by-side comparison to highlight the main differences:

| Feature | Branch | Subsidiary |

|---|---|---|

| Legal Status | Not separate from the parent company | Separate legal entity |

| Liability | Parent company is fully liable | Liability is generally limited to the subsidiary |

| Regulatory Burden | Fewer initial registration steps, but parent must file financial information | Must meet all Companies House obligations like a UK company |

| Taxation | Branch profits are taxed in the UK; profits are attributed to the parent | Subsidiary is taxed independently in the UK |

| Perception | Viewed as an extension of a foreign entity | Viewed as a domestic UK company |

| Management Control | Controlled directly by the parent | Operates independently but with oversight |

| Closure | Simpler to close | Requires formal liquidation or dissolution processes |

Advantages of Setting Up a Branch

Choosing a branch can offer several benefits for certain types of businesses:

1. Lower Initial Costs

Setting up a branch is generally faster and less expensive than creating a new legal entity. If you’re looking for a “test the waters” approach in the UK market without investing heavily upfront, a branch could be ideal.

2. Simplified Operations

Since a branch is an extension of the parent company, there is no need to maintain a separate set of corporate governance structures. Corporate decision-making stays centralized, which can streamline operations.

3. Transparency

Operating as a branch can enhance transparency with stakeholders and customers, particularly if the parent company already enjoys a strong reputation internationally.

Disadvantages of a Branch

Despite its simplicity, a branch comes with significant risks:

1. Unlimited Liability

The parent company bears full responsibility for the debts, obligations, and legal issues arising from the branch’s operations. This could expose the parent to financial or reputational risks.

2. Limited Perception

Many clients, suppliers, and even banks may prefer working with a locally incorporated entity rather than a foreign branch, especially for long-term contracts.

3. Reporting Requirements

Branches must file accounts with Companies House, including the parent company’s financial statements (translated into English if necessary), which could expose sensitive information to competitors.

Advantages of Setting Up a Subsidiary

For companies planning a more significant or permanent investment, a subsidiary can offer numerous advantages:

1. Limited Liability Protection

Since the subsidiary is a separate legal entity, the parent company’s exposure to financial and legal risks is limited. This creates a safety buffer.

2. Tax Planning Flexibility

A subsidiary is subject to UK corporation tax on its worldwide profits but can benefit from various UK tax treaties, R&D tax credits, and incentives available for UK-registered companies.

3. Stronger Local Presence

A UK-based limited company can improve credibility with customers, suppliers, investors, and government bodies. It signals a long-term commitment to the UK market.

4. Operational Autonomy

Subsidiaries can adapt operations, marketing strategies, and hiring practices to better suit the local market without needing constant parent company oversight.

Disadvantages of a Subsidiary

However, a subsidiary may not be suitable for every business:

1. Higher Setup and Compliance Costs

Incorporating a UK subsidiary involves legal and administrative costs, including appointing directors, preparing articles of association, and meeting ongoing Companies House reporting requirements.

2. Complexity

Managing a separate legal entity adds complexity, from hiring staff to setting up UK bank accounts and adhering to local employment laws.

3. Potential Double Taxation

Without careful tax planning, there is a risk of the parent company and subsidiary both being taxed on certain profits, although tax treaties often mitigate this.

Factors to Consider When Choosing Between a Branch and Subsidiary in 2025

When making your decision, think about the following factors:

1. Your Business Goals

- Short-term exploration? A branch might be better.

- Long-term growth and investment? A subsidiary usually makes more sense.

2. Risk Appetite

- Want to limit financial exposure? Choose a subsidiary.

- Comfortable with risk and looking for simplicity? A branch could suffice.

3. Tax Implications

Tax treatment for branches and subsidiaries can differ significantly. Consulting with UK tax professionals is highly recommended to avoid unexpected liabilities.

4. Industry Norms

Some industries (e.g., banking, insurance, and financial services) have strict regulatory expectations that favor one structure over another.

5. Brand and Market Strategy

Building a strong, trusted local brand presence often leans toward establishing a subsidiary rather than operating under the umbrella of a foreign entity.

Setting Up: Basic Steps for Each

Setting Up a Branch:

- Register with Companies House.

- Provide details about the parent company.

- Appoint a UK-based representative.

- File parent company accounts annually.

Setting Up a Subsidiary:

- Choose a company name.

- Prepare and file incorporation documents with Companies House.

- Appoint directors and a company secretary (optional).

- Set up a registered office address in the UK.

- Open UK bank accounts, register for taxes (VAT, corporation tax, etc.), and comply with local employment laws if hiring.

Future Trends: What to Expect in 2025

The UK business environment is expected to remain attractive in 2025, but there are key trends you should anticipate:

- Digital Compliance: More reporting obligations (like mandatory digital filing) may become the norm.

- Focus on Sustainability: Companies with strong Environmental, Social, and Governance (ESG) credentials will have an edge.

- Immigration Changes: New rules affecting skilled worker visas may impact talent acquisition strategies for both branches and subsidiaries.

- Regional Expansion: Beyond London, regions like Manchester, Birmingham, and Leeds are becoming hotspots for overseas investment.

Being ahead of these trends can help you fine-tune your branch or subsidiary operations for long-term success.

Conclusion: Which Should You Choose?

There is no one-size-fits-all answer to whether you should establish a branch or a subsidiary in the UK for your 2025 expansion.

- If you prioritize flexibility, lower costs, and minimal local structure — and can manage higher risks — a branch might be appropriate.

- If you aim for a strong market presence, operational independence, and risk containment, a subsidiary is usually the better route.

Each business has unique needs, so consider speaking with legal, tax, and corporate advisors specializing in UK market entry before making your final decision. With careful planning, your 2025 UK expansion can be the start of a major growth journey.

📋 Expansion Checklist: Choosing Between Branch and Subsidiary in the UK

✅ 1. Define Business Objectives

- Short-term market entry or long-term establishment?

- Testing waters or building a full operation?

✅ 2. Assess Risk Appetite

- Is your company willing to take on full liability (Branch)?

- Prefer to shield the parent company from UK risks (Subsidiary)?

✅ 3. Budget for Setup and Compliance

- Lower initial cost acceptable (Branch)?

- Ready to invest in full legal entity setup (Subsidiary)?

✅ 4. Tax Planning

- Consult a UK tax advisor for:

- Corporation tax obligations

- Transfer pricing

- Withholding taxes

✅ 5. Market Perception

- Is local credibility important to win contracts?

- Would UK clients trust a branch or prefer a UK-registered company?

✅ 6. Operational Flexibility

- Want direct parent control (Branch)?

- Prefer a locally autonomous team (Subsidiary)?

✅ 7. Regulatory Requirements

- Understand Companies House reporting duties

- Prepare for GDPR compliance

- Employment law readiness if hiring staff

✅ 8. Future Scalability

- Will you need multiple offices later?

- Plan for branch-to-subsidiary transition if needed